Large portion of influx will be for fleet modernization, replacement

MIAMI — Boeing on Wednesday fine-tuned last summer’s projection that air cargo demand will double over the next 20 years, fueling a 60% expansion in the global freighter fleet.

The biennial World Air Cargo Forecast was essentially unchanged from conclusions presented in Boeing’s broader commercial market outlook but did add some details.

The analysis projects airfreight volumes will increase at a compound annual rate of 4.1% through 2041 based on expected growth in global trade, industrial production and e-commerce.

That translates to nearly 2,800 production and converted freighters to meet anticipated volumes, including 940 factory-built widebody models. About half of the new aircraft will replace older, less-efficient aircraft and the rest will support greater shipping demand. A third of deliveries will consist of factory-built freighters, while the remainder will be used passenger aircraft converted to carry heavy containers in the main cabin.

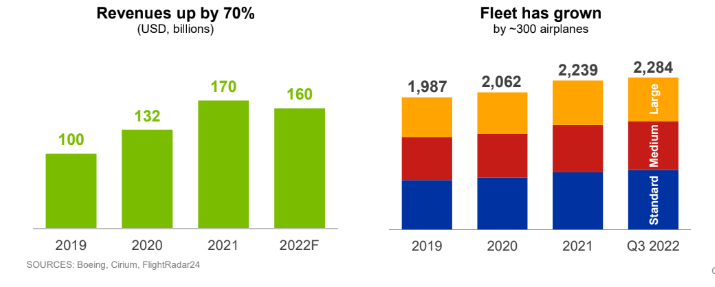

The worldwide fleet of standard, medium and large cargo jets will grow 2.7% per year, from 1,300 units to more than 3,600 jets, over the next two decades, Boeing (NYSE: BA) said. The Asia-Pacific region will take delivery of 40% of all new freighters.

The number of aircraft required would be greater were it not for improvements in fuel efficiency and productivity, Darren Hulst, vice president of marketing for Commercial Airplanes, said during a briefing for reporters at The International Air Cargo Association’s forum here.

We see aircraft that are more capable and more productive. That helps support the fleet needs over the next 20 years,” he said.

A steady slump in air cargo volumes since March after two years of extraordinary pandemic-driven growth hasn’t changed long-term growth projections, especially since several structural factors favor increased utilization of aircraft for goods movement.

Boeing’s cargo forecast assumes global trade growth continues at an annual rate of 2.8%. Other influences on freighter demand include:

- The inexorable growth in e-commerce and express networks to move packages.

- New market entrants such as passenger airlines (Air Canada, WestJet and Sun Country) and ocean carriers (Maersk, CMA CGM and Mediterranean Shipping Co.) starting or growing cargo airlines to diversify their logistics offerings with a faster-service option.

- E-commerce platforms like Mercado Libre in South America and Alibaba’s logistics arm establishing private airlines, using airline partners such as Brazil’s Gol, to expedite B2C and B2B deliveries.

- Better competitiveness with ocean shipping as container lines become more disciplined managing capacity to maintain higher rates.

Hulst said Boeing has counted about 40 new cargo operators in the past two years. The report said 90% of air cargo revenues for the entire industry are generated by airlines that fly at least some dedicated freighters, meaning airlines with combined passenger and freighter fleets or all-cargo operators, which help explain some of the renewed interest in freighter investments.

The report also highlighted other market changes that can tip shipping needs toward the air mode. Since 2018, there has been a 23% increase in U.S. domestic air tonnage against only a 1% increase in trucking, which officials explained as a temporary phenomenon due to the e-commerce explosion, a shortage of truck drivers and supply chain disruptions during the pandemic.

And since 2019 the amount of industrial machinery transported from the U.S. to Chile has quadrupled to support mining of lithium for electric batteries.

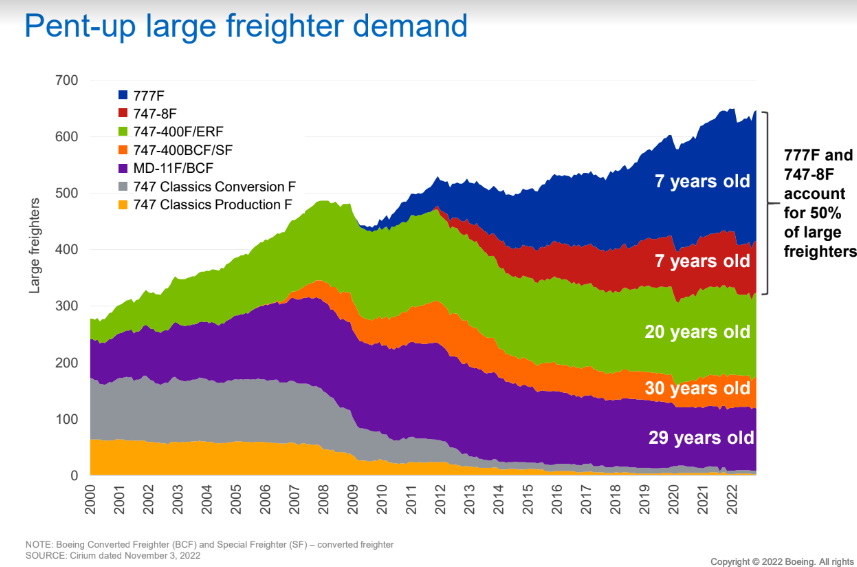

Data from Boeing shows that more than half the fleet of large freighters is more than 20 years old and will need to be replaced by more modern planes in the coming years. During the COVID crisis many cargo planes that never would have flown again under normal circumstances were brought out of storage in response to a shortage of airlift caused by the pulldown of passenger flights. How much longer many of those planes can remain in service with the high cost of jet fuel and lower rates remains to be seen.

“That means over 300 jets that are 80 tons or larger [in payload] are either in need of replacement now or will be by the end of this decade,” said Hulst.

Boeing will produce its last 747-8 in the first quarter of 2023. The 767 medium widebody and large 777 freighters will continue to be built through 2027, when international regulations requiring cleaner engine types kick in. The manufacturer on Tuesday announced that Emirates ordered five 777 cargo jets.

Hulst said freighters will carry more than 50% of cargo compared to a more even split prior to the pandemic.

Boeing’s replacement for the 777 and 747 is the 777-8, which is planned to enter service in late 2027. Rival Airbus recently introduced the A350 freighter to go against the 777-8. Aviation intelligence firm Cirium counts 43 firm orders for the 777-8 from four customers, not including about 16 options. The A350 has 31 orders so far.

Boeing achieved a record for freighter sales last year — conversions and new — and through October 2022 has sold nearly 80 production freighters.

Hulst said there won’t be much near-term impact on shippers that need to move oversize shipments because are still more than 300 nose-loading 747 jumbo jets in operation and many will continue to fly into the 2050s. Only about 2% of shipments by tonnage require extra-large freighters.

Airbus (DXE: AIR) last summer issued a more conservative prediction for annual airfreight traffic of 3.2%, with the express sector leading the way with 4.9% growth.

The manufacturers use the forecasts to help sell aircraft. Consulting firm McKinsey forecasts cargo demand will grow 2.5% to 3% per year through 2031.