Retail fuel outlets including truck stops who must weigh investment in electric vehicle chargers say they face such challenges as customer “range anxiety,” high utility charges for electricity and political policy uncertainties.

Several executives told a Natso virtual webinar titled, “Business Case for EV Charging at Retail,” that even when retailers do make the investments, they don’t plan on seeing any profit for at least a few years, Transport Topics reports.

“We are definitely in an evaluative mode right now where we are looking at demand for electric vehicle charging infrastructure in various parts of the country,” said Tim Langenkamp, vice president and general counsel for Pilot Co.’s energy division. “But the demand is not uniform across the nation. The regulatory environment is definitely in flux, and there needs to be a successful energy transition with as few dropped balls as possible.”

One of the biggest obstacles to that successful transition is for utility companies to offer reasonable electricity rates to retailers wanting to install chargers on their properties, said Eva Rigamonti, associate general counsel for RaceTrac Inc.

“I think the rate structure is a huge impediment to private investment,” Rigamonti said.

Retailers and charge providers are clearly hoping to receive assistance from federal and state grants to begin building out a charging infrastructure.

Another challenge is motorist “range anxiety,” said David Fialkov, Natso’s executive vice president of government affairs.

“Even if you don’t live in a house with a garage with your own charger or in an apartment building where you don’t have overnight parking with access to a charging station, you can have range anxiety even when you’re not traveling far,” he said. “Even going to a charging station in town, it must be a fast-charging station.”

Read the full article here.

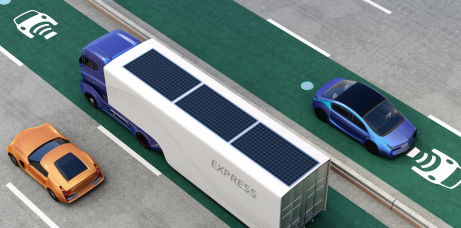

In a related article from Trickinginfo.com, WiTricity, a company that provides wireless charging systems, released results of a study that evaluated the relative total cost of ownership (TCO) of adopting and running an electric vehicle (EV) fleet for last-mile parcel delivery when those vehicles were equipped with wireless charging instead of plug-in charging.

It found that when untethered from the cord, vehicles have more time to charge, and can do so at lower power, such as at the dock being loaded, at the depot being cleaned or prepped, or while parked.

The study found that when using wireless charging technology, last-mile EV fleets saved up to 50% in TCO.

In a standard plug-in model, EVs are taken out of service to charge: a driver moves the EV to the charger, plugs in, and there the EV remains until sufficiently charged. In contrast, wireless charging lets fleets adapt their charging model to existing business workflows by bringing the charge to the EVs where they are: at the dock being loaded, at the depot being cleaned or prepped, or while parked. Untethered from the cord, vehicles have more time to charge, and can do so at lower power.

The outcome: lower costs by flattening the curve on “demand charges,” the compensation paid to the utility for maintaining the grid with sufficient capacity to energize a customer’s needs at peak draw. Given that electric utility charges are one of the top three components of the lifetime cost of an EV (the other two are vehicle miles traveled and vehicle purchase price), the result is a reduction in the overall TCO of going electric.

“With businesses and government agencies upgrading their last-mile fleets to be electric — from delivery vans to mail trucks — there are clear, major benefits of being able to charge those wirelessly,” said Alex Gruzen, WiTricity CEO. “Our analysis shows that WiTricity’s technology introduces great flexibility with significantly lower costs.”

Read full article here.